What Are Your Rights Against Debt Collection Abuse?

Ready to resolve your legal concerns? Get professional help now with personalized support, Or Call 833-349-4659 for immediate assistance.

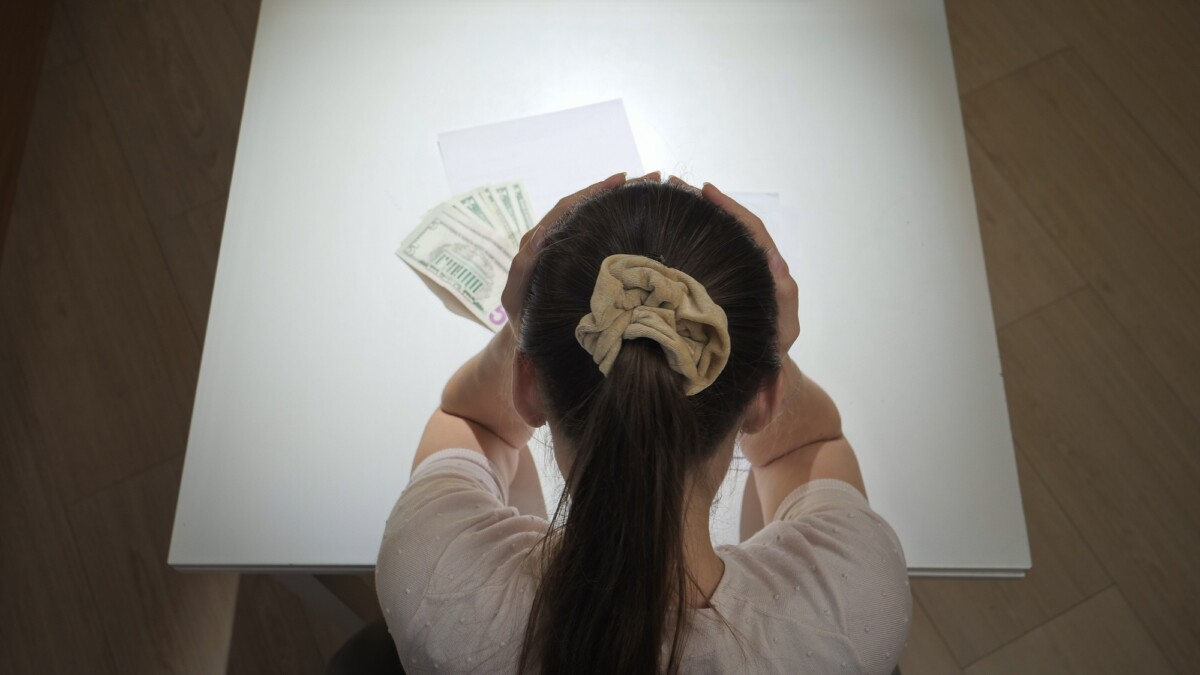

Understanding your rights against Debt Collection Abuse Attorney is crucial for protecting yourself from unfair practices. Many individuals face aggressive tactics from debt collectors, which can lead to stress and confusion. Knowing your rights can empower you to take action and seek help when needed.

What Is Debt Collection Abuse?

Debt collection abuse refers to illegal practices used by collectors to pressure or intimidate debtors. This can include harassment, threats, or misleading information. If you feel overwhelmed by aggressive collection tactics, consulting a Debt Collection Abuse Attorney can help you navigate your rights and options.

Your Rights Under the Fair Debt Collection Practices Act (FDCPA)

- No Harassment: Collectors cannot use abusive language or threaten violence.

- Truthful Communication: They must provide accurate information about your debt.

- Validation of Debt: You have the right to request proof of the debt.

- Cease Communication: You can ask them to stop contacting you, which they must respect.

Understanding these rights is essential for anyone facing debt issues, including those seeking Business Debt Relief or assistance from organizations like Debt Clear USA.

Your Legal Rights: Protections Against Harassment

Understanding your rights against debt collection abuse is crucial for protecting yourself from harassment and unfair practices. Many individuals are unaware of the legal protections available to them, which can lead to unnecessary stress and confusion. Knowing your rights empowers you to take action and seek help from a Debt Collection Abuse Attorney if needed.

Key Protections Under the Fair Debt Collection Practices Act (FDCPA)

- No Harassment: Debt collectors cannot use abusive language or threaten violence.

- Communication Restrictions: They must not contact you at inconvenient times, such as late at night.

- Validation of Debt: You have the right to request proof of the debt, ensuring its legitimacy.

Steps to Take if You Experience Abuse

- Document Everything: Keep records of all communications with debt collectors.

- Report Violations: File a complaint with the Consumer Financial Protection Bureau (CFPB).

- Seek Legal Help: Consult a Debt Collection Abuse Attorney to explore your options for business debt relief or personal debt resolution through services like Debt Clear USA.

If you feel overwhelmed by debt collection practices, remember that you are not alone. Many people face similar challenges, and there are resources available to help you navigate these issues. By understanding your rights and seeking assistance, you can work towards a more peaceful financial future.

When to Contact a Debt Collection Abuse Attorney

Understanding your rights against debt collection abuse is crucial for protecting yourself from unfair practices. Debt collectors often use aggressive tactics that can lead to stress and confusion. Knowing when to contact a Debt Collection Abuse Attorney can empower you to take control of your situation and seek justice.

Signs of Abuse

- Harassment through frequent calls

- Threats of legal action or wage garnishment

- Calling at odd hours or to your workplace

If you experience any of these behaviors, it’s time to consult a Debt Collection Abuse Attorney. They can help you navigate the complexities of your case and ensure your rights are upheld.

Seeking Business Debt Relief

If your business is facing aggressive debt collection, don’t hesitate to reach out for help. A Debt Collection Abuse Attorney can assist in finding effective Business Debt Relief solutions, allowing you to focus on your business’s growth without the burden of harassment. Remember, you have options to clear your debts with dignity through services like Debt Clear USA.

Common Tactics Used by Debt Collectors: Know Your Enemy

Understanding your rights against debt collection abuse is crucial for protecting yourself from unfair practices. Debt collectors often use aggressive tactics that can lead to stress and confusion. Knowing your rights empowers you to stand up against these practices and seek help when necessary.

Harassment and Intimidation

Debt collectors may resort to harassment, including repeated phone calls at odd hours or threats of legal action. Remember, you have the right to request that they cease communication.

Misrepresentation

Some collectors might misrepresent themselves or the debt’s status. If you suspect this, consult a Debt Collection Abuse Attorney to understand your options and protect your rights.

Unfair Practices

Debt collectors cannot engage in unfair practices, such as adding unauthorized fees or contacting your employer without your consent. If you experience this, consider reaching out to Debt Clear USA for guidance on your next steps.

By recognizing these tactics, you can better defend yourself and explore avenues for Business Debt Relief if needed.

Documenting Abuse: How to Keep Records of Harassment

Understanding your rights against debt collection abuse is crucial for protecting yourself from harassment. Debt collectors often use aggressive tactics that can be overwhelming. Knowing how to document these interactions can empower you and provide evidence if you decide to take legal action with a Debt Collection Abuse Attorney.

Keep Detailed Records

- Date and Time: Note when each interaction occurs.

- Method of Communication: Record whether it was a phone call, letter, or email.

- Content of Conversation: Write down what was said, including any threats or misleading information.

Organize Your Documentation

Maintaining organized records can help you identify patterns of abuse. Use folders or digital tools to categorize your documentation. This will be invaluable if you seek Business Debt Relief or need to file a complaint against the collector. If you feel overwhelmed, consider reaching out to organizations like Debt Clear USA for guidance. They can assist you in understanding your rights and help you navigate the complexities of debt collection laws. Remember, you have the right to dispute any debt and protect yourself from harassment.

Filing a Complaint: Steps to Take Against Debt Collectors

Understanding your rights against debt collection abuse is crucial for protecting yourself from unfair practices. Debt collectors often use aggressive tactics that can be overwhelming. Knowing how to respond can empower you and help you regain control over your financial situation.

Document Everything

- Keep records of all communications with debt collectors.

- Note dates, times, and the content of conversations.

Contact a Debt Collection Abuse Attorney

- Consulting a Debt Collection Abuse Attorney can provide you with expert guidance.

- They can help you understand your rights and navigate the complaint process effectively.

File a Complaint

- You can file a complaint with the Consumer Financial Protection Bureau (CFPB).

- Additionally, consider reporting to your state’s attorney general.

- This can lead to investigations and potential penalties against abusive collectors.

Explore Business Debt Relief Options

- If you’re struggling with business debts, look into Business Debt Relief programs.

- These can offer solutions tailored to your specific financial situation, helping you clear debts efficiently.

Ready to resolve your legal concerns? Get professional help now with personalized support, Or Call 833-349-4659 for immediate assistance.

The Role of a Debt Collection Abuse Attorney in Your Case

Understanding your rights against debt collection abuse is crucial for protecting yourself from harassment and unfair practices. Many individuals are unaware of the legal protections available to them, which can lead to unnecessary stress and financial strain. This is where a Debt Collection Abuse Attorney can play a vital role in your case.

How a Debt Collection Abuse Attorney Can Help

A Debt Collection Abuse Attorney specializes in defending consumers against aggressive debt collection tactics. They can help you understand your rights under the Fair Debt Collection Practices Act (FDCPA) and ensure that collectors adhere to legal guidelines. Here are some ways they can assist you:

- Evaluate Your Case: They will assess the details of your situation to determine if you have a valid claim.

- Negotiate on Your Behalf: An attorney can communicate with debt collectors, potentially reducing the amount owed or negotiating a payment plan.

- File Complaints: If necessary, they can file complaints with the Consumer Financial Protection Bureau (CFPB) or take legal action against abusive collectors.

If you’re seeking Business Debt Relief, a knowledgeable attorney can also guide you through options tailored to your business needs, ensuring you achieve a Debt Clear USA status effectively.

Read Also: How Can Business Debt Relief Help Struggling Companies?

What to Expect During the Legal Process: A Guide for Consumers

Understanding your rights against debt collection abuse is crucial for protecting yourself from unfair practices. Many consumers feel overwhelmed when dealing with aggressive debt collectors, but knowing your rights can empower you. This guide will help you navigate the legal process and understand what to expect when facing debt collection issues.

Key Rights Under the Fair Debt Collection Practices Act (FDCPA)

- No Harassment: Debt collectors cannot use abusive language or threaten you.

- Validation of Debt: You have the right to request proof of the debt.

- Communication Restrictions: You can limit when and how collectors contact you.

Steps to Take if You Experience Abuse

- Document Everything: Keep records of all communications.

- Contact a Debt Collection Abuse Attorney: They can provide guidance and represent you.

- Consider Business Debt Relief Options: If applicable, explore solutions that can help you manage your debts effectively.

Seeking Help from Debt Clear USA

If you feel overwhelmed, organizations like Debt Clear USA can assist you in understanding your rights and finding relief from abusive debt collection practices. They can help you navigate your options and work towards a solution that fits your needs.

How FormsByLawyers Can Help You Fight Back Against Debt Collection Abuse

Understanding your rights against debt collection abuse is crucial for protecting yourself from aggressive tactics. Many individuals are unaware of the legal protections available to them, which can lead to unnecessary stress and financial strain. At Debt Clear USA, we empower you to stand up against these practices and reclaim your peace of mind.

Know Your Rights

- You have the right to be treated fairly and without harassment.

- Debt collectors cannot call you at unreasonable hours or use threats.

Legal Support from a Debt Collection Abuse Attorney

A Debt Collection Abuse Attorney can provide invaluable assistance. They can help you understand your rights, negotiate with collectors, and even represent you in court if necessary. With their expertise, you can navigate the complexities of debt collection laws effectively.

Business Debt Relief Options

If you’re a business owner facing debt collection abuse, options for Business Debt Relief are available. This includes negotiating payment plans or exploring bankruptcy options. Our team at Debt Clear USA is here to guide you through these processes, ensuring you make informed decisions that protect your business’s future.

Don’t let legal complexities hold you back. Start your free consultation here or call 833-349-4659 now.

You can also visit LegalCaseReview to find the best Lawyer.

FAQs

-

What is debt collection abuse?

Debt collection abuse occurs when a creditor or collection agency uses harassing, deceptive, or unfair tactics to collect a debt. This includes threats, excessive phone calls, misrepresentation, or attempting to collect debts that are not owed. -

What laws protect consumers from debt collection harassment?

The Fair Debt Collection Practices Act (FDCPA) and the Consumer Financial Protection Bureau (CFPB) protect consumers from abusive, unfair, and deceptive collection practices. -

What are common examples of debt collection abuse?

- Calling repeatedly at odd hours

- Using threats or abusive language

- Misrepresenting the amount owed

- Contacting your employer or family about your debt

- Falsely claiming legal action against you

-

Can a debt collector threaten me with arrest or jail time?

No. It is illegal for debt collectors to threaten arrest, jail time, or criminal charges for unpaid debts. -

Can I sue a debt collector for harassment?

Yes. Under the FDCPA, you can file a lawsuit against a debt collector for abusive or illegal practices and may be entitled to damages.