How to Create a Debt Resolution Agreement?

Ready to resolve your legal concerns? Get professional help now with personalized support, Or Call 833-349-4659 for immediate assistance.

Creating a successful Debt Resolution Agreement is essential for anyone facing debt challenges. This agreement helps you regain control over your finances and sets the stage for a brighter future. But how do you create one? Let’s explore the basics.

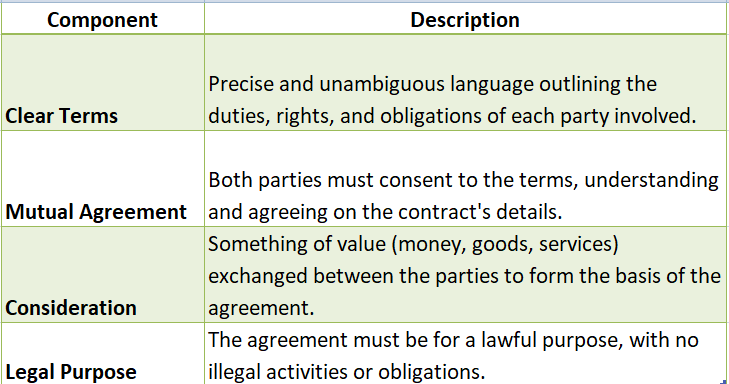

A Debt Resolution Agreement is a formal contract between you and your creditors, detailing how you will repay your debts, often for less than the total owed. Here are the key components:

Key Components of a Debt Resolution Agreement

- Clear Terms: Clearly state the total debt and the settlement amount.

- Payment Plan: Define how and when payments will occur.

- Creditor Agreement: Ensure all parties sign to make it legally binding.

Working with Debt Settlement Firms

Navigating this process can be daunting, which is where Debt Settlement Firms can assist. They negotiate on your behalf, simplifying the process. Just ensure you choose a reputable firm to avoid scams.

Benefits of a Debt Resolution Agreement

- Reduced Debt: Potentially pay less than owed.

- Financial Relief: Alleviates stress from overwhelming debt.

- Improved Credit Score: Settling debts can enhance your credit over time.

Steps to Create Your Agreement

- Assess Your Debt: List all debts and amounts.

- Research Options: Consider Debt Settlement Firms if necessary.

- Negotiate Terms: Discuss settlements with creditors.

- Draft the Agreement: Clearly outline all terms.

- Get Everything in Writing: Ensure all parties sign the final document.

What Are the Key Components of a Successful Agreement?

Creating a successful Debt Resolution Agreement is crucial for anyone looking to regain control over their finances. It not only helps you settle your debts but also paves the way for a fresh start. Understanding the key components of such an agreement can make all the difference in your financial journey.

Clear Terms and Conditions

A successful Debt Resolution Agreement should have clear terms. This means specifying the total debt amount, the settlement amount, and the payment schedule. Clarity helps avoid misunderstandings later on, ensuring both parties are on the same page.

Involvement of Debt Settlement Firms

Working with reputable Debt Settlement Firms can enhance your chances of success. These firms have experience negotiating with creditors and can help you craft an agreement that meets your needs. They know the ins and outs of the process, making it smoother for you.

Realistic Payment Plans

Lastly, a successful agreement includes a realistic payment plan. It should fit your budget and be achievable. This way, you can stick to the plan without feeling overwhelmed. Remember, the goal is to resolve your debt, not create more stress!

How to Assess Your Financial Situation Before Negotiating

Before diving into a Debt Resolution Agreement, it’s crucial to understand your financial situation. Knowing where you stand financially can empower you during negotiations with debt settlement firms. This clarity helps you make informed decisions and increases your chances of a successful agreement.

Evaluate Your Income and Expenses

Start by listing your monthly income and expenses. This will give you a clear picture of your cash flow. Consider these steps:

- Track your income: Include all sources like salary, bonuses, and side jobs.

- List your expenses: Don’t forget bills, groceries, and discretionary spending.

This assessment will help you identify how much you can realistically allocate towards settling your debts.

Determine Your Debt Amounts

Next, gather information about your debts. Knowing the total amount owed is essential for negotiating effectively. Here’s how to do it:

- List all debts: Include credit cards, loans, and any other obligations.

- Check interest rates: Understanding these can help prioritize which debts to tackle first.

- Contact creditors: If unsure, reach out to get accurate balances.

With this information, you’ll be better prepared to discuss a Debt Resolution Agreement that works for you.

Tips for Negotiating with Creditors Effectively

Creating a successful Debt Resolution Agreement is crucial for anyone struggling with debt. It can help you regain control of your finances and pave the way for a brighter financial future. But how do you negotiate effectively with creditors to achieve this? Let’s explore some tips that can make a significant difference.

Do Your Homework

Before you start negotiating, gather all your financial information. Know how much you owe, the interest rates, and your budget. This knowledge will empower you during discussions and show creditors that you are serious about resolving your debt.

Be Honest and Direct

When speaking with creditors, honesty is key. Explain your situation clearly and let them know why you need a Debt Resolution Agreement. Most creditors appreciate transparency and may be more willing to work with you if they understand your circumstances.

Consider Debt Settlement Firms

If negotiating feels overwhelming, consider working with Debt Settlement Firms. They specialize in negotiating with creditors on your behalf, which can take some pressure off you. Just ensure you choose a reputable firm to avoid scams.

Stay Calm and Patient

Negotiating can be stressful, but staying calm is essential. Be patient and prepared for back-and-forth discussions. Remember, the goal is to reach a mutually beneficial agreement, so keep the lines of communication open.

Ready to resolve your legal concerns? Get professional help now with personalized support, Or Call 833-349-4659 for immediate assistance.

Common Mistakes to Avoid in Debt Resolution Agreements

Creating a successful Debt Resolution Agreement is crucial for anyone looking to regain control over their finances. It’s not just about settling debts; it’s about building a brighter financial future. However, many people make mistakes that can hinder their progress. Let’s explore some common pitfalls to avoid when drafting your agreement.

Lack of Clear Communication

One major mistake is not communicating clearly with your creditors. If you’re working with Debt Settlement Firms, ensure they understand your financial situation. Miscommunication can lead to misunderstandings, making it harder to reach a satisfactory agreement.

Ignoring the Fine Print

Always read the fine print! Some agreements may have hidden fees or unfavorable terms. Take your time to understand every detail before signing. Ignoring this can lead to unexpected costs down the line.

Rushing the Process

Lastly, don’t rush into a Debt Resolution Agreement. Take the time to evaluate your options and consult with professionals if needed. A hasty decision can result in a less favorable outcome. Remember, it’s better to take a little longer and get it right than to rush and regret it later.

Read Also: How to Find the Best Debt Collection Attorney Near You?

How Can FormsByLawyers Help You Create a Tailored Debt Resolution Agreement?

Creating a successful Debt Resolution Agreement is essential for regaining control over your finances and achieving financial freedom. At FormsByLawyers, we recognize that every financial situation is unique, which is why we offer a tailored approach to meet your needs.

When you choose to work with us, you become more than just a number. We focus on understanding your specific financial circumstances. Here’s how we assist you:

Personalized Assessment

- We conduct a thorough evaluation of your debts and income to identify the best strategies for your Debt Resolution Agreement.

Expert Guidance

- Our experienced team from reputable Debt Settlement Firms will guide you through the process, ensuring clarity at every step.

Customized Solutions

- We design a Debt Resolution Agreement tailored to your needs, enhancing your chances of successfully settling your debts.

Ongoing Support

- Our commitment doesn’t end with the agreement; we provide continuous support and answer any questions you may have.

Negotiation Skills

- We utilize our relationships with creditors to negotiate better terms, potentially leading to lower payments and quicker debt resolution.

Financial Education

- We empower you with knowledge through our resources, helping you manage your finances more effectively in the future.

The Importance of Following Up After Reaching an Agreement

After reaching a Debt Resolution Agreement, many people think the hard part is over. However, the journey doesn’t end there. Following up is crucial to ensure that the agreement is honored and that you stay on track with your financial goals. This step can make a significant difference in your debt recovery process.

Why Follow-Up Matters

Following up after your agreement is essential for several reasons:

- Confirm Compliance: Make sure that the debt settlement firms are adhering to the terms of your agreement.

- Track Progress: Regular check-ins help you monitor your financial situation and adjust your budget accordingly.

- Build Trust: Keeping communication open with your creditors fosters a positive relationship, which can be beneficial in the long run.

How to Follow Up Effectively

Here are some simple steps to ensure you’re on top of your agreement:

- Set Reminders: Schedule regular reminders to check in with your creditors or debt settlement firms.

- Document Everything: Keep records of all communications and payments made.

- Ask Questions: Don’t hesitate to reach out if you have concerns or need clarification about your agreement.

By following these steps, you can ensure that your Debt Resolution Agreement leads to a successful outcome, helping you regain control of your finances.

Don’t let legal complexities hold you back. Start your free consultation here or call 833-349-4659 now.

You can also visit LegalCaseReview to find the best Lawyer.

FAQs

-

What is a Debt Resolution Agreement?

A Debt Resolution Agreement is a formal arrangement between a borrower and a creditor to reduce or restructure outstanding debt. It may involve lowering the total amount owed, extending payment terms, or negotiating a settlement amount. -

How does a Debt Resolution Agreement work?

The borrower and creditor agree to modify the terms of the debt, which may include lowering the interest rate, reducing the total amount due, or setting a more manageable payment schedule. -

Who is eligible for a Debt Resolution Agreement?

Eligibility typically depends on the borrower’s financial situation, such as their ability to pay and the type of debt involved. Creditors will generally consider agreements for individuals who are struggling with debt but show good faith in resolving it. -

What types of debts can be included in a Debt Resolution Agreement?

Debt resolution can apply to various types of unsecured debt, such as credit card debt, medical bills, personal loans, or payday loans.

-

How long does it take to negotiate a Debt Resolution Agreement?

The process can vary depending on the complexity of the debt and the responsiveness of the creditor. It can take several weeks to months to negotiate a resolution. -

Do I need a lawyer to negotiate a Debt Resolution Agreement?

While not required, having a financial advisor or attorney can be helpful in negotiating favorable terms and ensuring that the agreement is legally binding and protects your interests.